Can your investments change the world while building your wealth? At StakePro Wealth Advisors, we demonstrate how aligning your portfolio with your personal values not only drives positive social and environmental change but can also enhance your financial returns.

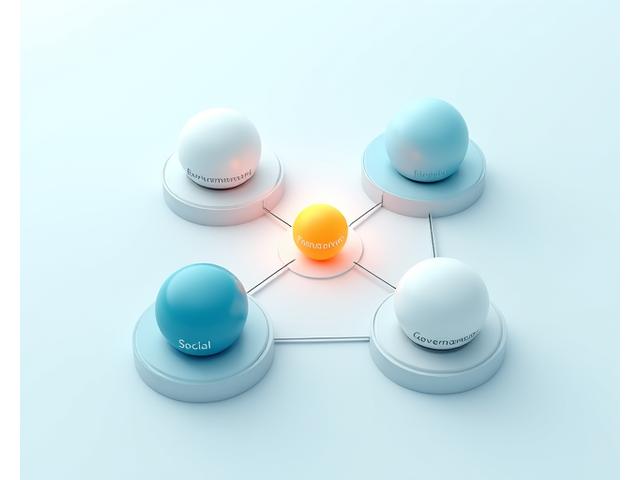

Today's sophisticated investors recognize that ESG (Environmental, Social, and Governance) factors are not just about ethics; they are critical indicators of a company's long-term resilience and growth potential. Our approach moves beyond simple exclusionary screening, focusing on positive integration and measurable impact.

At StakePro, we employ a rigorous framework to integrate Environmental, Social, and Governance factors into your investment decisions. This holistic approach ensures your portfolio is built on a foundation of sound financial principles combined with a commitment to a better future.

Our deep analysis includes quantitative ESG scoring, seamlessly integrated with traditional fundamental analysis. We also engage in active ownership, utilizing proxy voting and direct dialogue to encourage corporate responsibility.

Beyond broad ESG integration, StakePro offers direct impact investing opportunities designed to generate specific, measurable social and environmental benefits alongside financial returns. These are not merely 'feel-good' investments; they are strategic allocations driving tangible progress.

We pride ourselves on transparent impact measurement and reporting, ensuring you can clearly see the real-world outcomes of your investments. Experience wealth creation with a conscience.

A common misconception is that values-aligned investing comes at the cost of financial performance. At StakePro, we provide compelling evidence that integrating ESG factors can lead to competitive, and often superior, risk-adjusted returns over the long term.

Our analysis includes historical performance comparisons, demonstrating how strong ESG practices can reduce risk and enhance resilience during market fluctuations. We delve into sector-specific and geographic ESG performance, leveraging academic research to validate our strategies and identify long-term trends.

The transition to a low-carbon economy presents both significant challenges and unparalleled investment opportunities. StakePro Wealth Advisors offers specialized climate-focused strategies to help you capitalize on this global shift, while contributing to a sustainable future.

We assess climate risk and adaptation capabilities within portfolios, and work to reduce the carbon footprint of your investments, aligning your wealth with the imperative of climate action.

Your values are unique, and your investment portfolio should reflect them. StakePro specializes in crafting highly personalized ESG portfolios that balance your financial objectives with your deeply held beliefs.

We conduct regular portfolio reviews, ensuring your investments continue to evolve with your priorities and the dynamic landscape of responsible investing. This is truly investing that reflects *you*.

Don't just take our word for it. Explore real-world examples of how StakePro clients have achieved their financial goals while making a significant positive impact on the world.

A philanthropic family foundation sought to align their substantial endowment with their mission of environmental conservation and social equity. Through StakePro's customized ESG integration, their portfolio not only grew by 12% annually for five years, outperforming the benchmark, but also significantly increased investments in sustainable agriculture and affordable housing. This dual success allowed them to expand their grant-making initiatives, doubling their annual impact.

A professional in her late 40s was passionate about ethical consumption and wanted her retirement savings to reflect her values. Our strategy focused on a diversified portfolio of companies with strong ESG ratings, particularly in renewable energy and ethical consumer goods. Over ten years, her portfolio consistently generated 9% average annual returns, allowing her to retire comfortably ahead of schedule, knowing her wealth was built responsibly.

A client concerned about climate change wanted to divest from fossil fuels and invest in solutions. StakePro crafted a portfolio heavily weighted towards clean energy infrastructure, electric vehicle technology, and carbon capture innovations. During a volatile period for traditional energy, this climate-focused portfolio demonstrated resilience and returned 15% in a single year, significantly outperforming market benchmarks. Their investments are now directly contributing to a lower-carbon future.

Ready to build wealth with purpose? Begin your journey towards a portfolio that reflects your values without compromising on financial growth. Our expert advisors are here to guide you.

Take the first step:

Or call us at +1-213-555-0188 or email at info@stakeprowealth.com