Will your retirement dreams become reality, or will you outlive your money? At StakePro Wealth Advisors, we understand the anxieties surrounding retirement. The traditional 401(k) is just one piece of a much larger, more complex puzzle. We craft comprehensive strategies designed to ensure you not only reach retirement but thrive in it, maintaining your desired lifestyle and protecting your financial dignity for decades to come.

of Americans are concerned about outliving their retirement savings.

Average life expectancy for those retiring today, underscoring longevity risk.

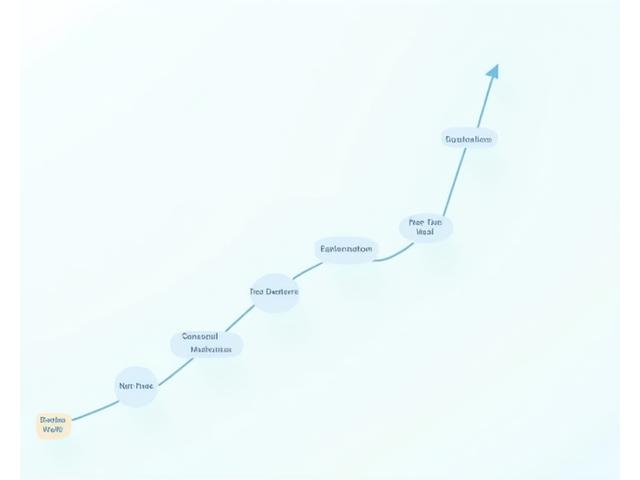

Your unique goals are at the core of our dynamic planning approach.

Crafting a stable, reliable income stream is the cornerstone of a successful retirement. Our approach shifts deftly from accumulation to distribution, employing advanced strategies to ensure consistent cash flow throughout your post-working life. We consider everything from bond ladders to dynamic withdrawal plans, ensuring your wealth works for you.

Minimizing your tax burden in retirement can significantly extend the longevity of your savings. We specialize in creating tax-efficient withdrawal sequences that leverage different account types, manage Required Minimum Distributions (RMDs), and strategically use Roth conversions to keep more of your hard-earned money.

Healthcare costs are one of the most significant and unpredictable expenses in retirement. We help you navigate Medicare options, evaluate long-term care insurance, and strategize on Health Savings Accounts (HSAs) to protect your assets from these potentially devastating costs.

Your retirement lifestyle should be a source of joy, not financial worry. We implement strategies to combat inflation, mitigate the risks of market volatility, and plan for unexpected life events, ensuring your purchasing power is maintained and your legacy is secure.

Don't just take our word for it—see how StakePro Wealth Advisors has helped clients achieve their ideal retirements. These are not just numbers; they are lives transformed by strategic planning and dedicated partnership.

"StakePro's detailed plan allowed me to retire five years earlier than planned, with a robust income stream that keeps my golf membership active!" Outcome: 100% income replacement, 5 years early retirement.

"Selling my business was complex, but StakePro ensured the proceeds were transitioned seamlessly into a tax-efficient retirement income plan." Outcome: 15% tax savings on capital gains, diversified retirement portfolio.

"Their guidance on Social Security and tax withdrawals saved us a fortune and gave us incredible peace of mind." Outcome: $120,000 additional lifetime Social Security benefits, 8% average annual tax reduction.

Are you on track for the retirement you envisioned? Our complimentary Retirement Readiness Assessment offers a holistic review of your current financial picture, identifies potential gaps, and outlines personalized recommendations to get you confidently to your goals.

No obligation. Just clarity and expert guidance.